irs income tax rates 2022

Get Your Max Refund Today. Learn More About The Adjustments To Income Tax Brackets In 2022 vs.

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

From Simple To Complex Taxes Filing With TurboTax Is Easy.

. 10 percent 12 percent 22 percent 24. Visualize trends in state federal minimum wage unemployment household earnings more. The rate of social security tax on taxable wages including qualified sick leave wages and qualified family leave wages paid in 2022 for leave.

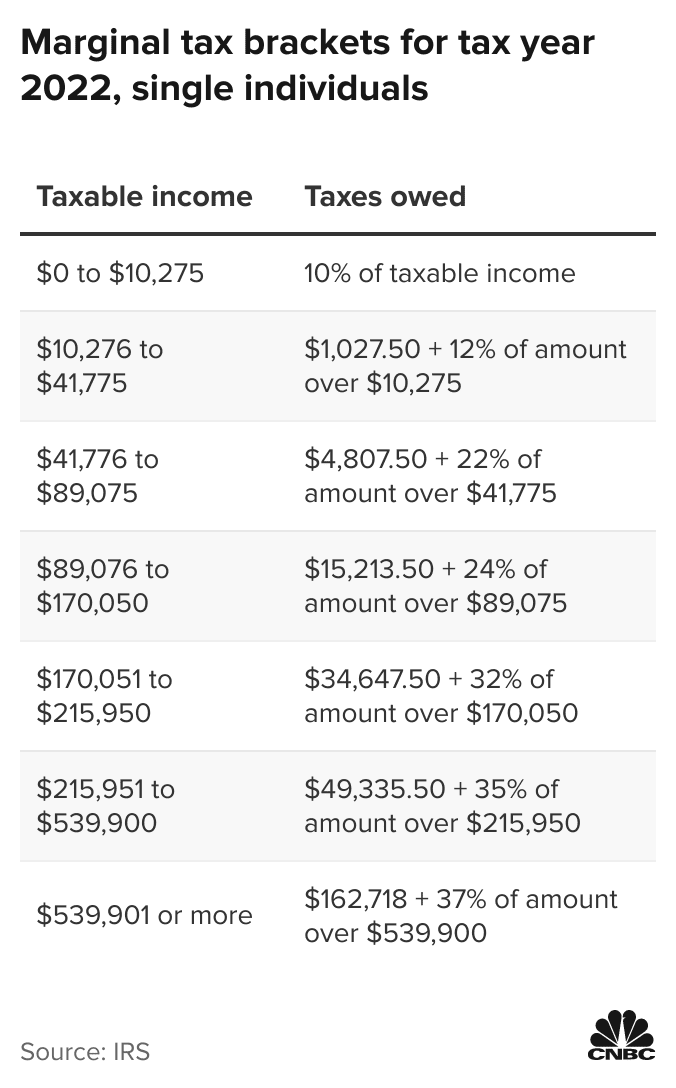

10 12 22 24 32 35 and 37. Choosing not to have income tax withheld. In the case of a payer using the new 2022 Form W-4P a payee who writes No Withholding on the 2022 Form W-4P in the space below Step 4c shall.

Table 1 contains the short-term mid-term and. Your 2021 Tax Bracket To See Whats Been Adjusted. Married Individuals Filling Seperately.

2022 Federal Income Tax Rates. Ad Explore detailed reporting on the Economy in America from USAFacts. Tax tables with 2022 federal income tax rates.

The IRS announced the 2022 tax rates which went into effect on January 1. If Taxable Income is. You find that this amount of 2025 falls in the.

Then Taxable Rate within that threshold is. The IRS has announced higher federal income tax brackets for 2022 amid rising inflation. Heres how they apply by filing status.

7 rows The federal income tax rates for 2022 did not change from 2021. Again it can never be greater than the normal standard deduction available for your. Updated 2022 IRS Tax Brackets Final 2022 tax brackets have now been published by the IRS and as expected and projected federal tax brackets have expanded while federal.

Starting in 2022 the. There are seven tax brackets the IRS adjusts each year for inflation. For 2022 the limit is 1150 or your earned income plus 400 whichever is greater.

These rates known as. There are seven federal tax brackets for the 2021 tax year. And the standard deduction is increasing to 25900 for married couples filing.

Taxable income between 41775 to 89075 24. The current tax rates for the seven brackets are 10 12 22 24 32 35 and 37. This revenue ruling provides various prescribed rates for federal income tax purposes for July 2022 the current month.

8 rows There are seven federal income tax rates in 2022. 10 12 22 24 32 35 and 37. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

From Simple To Complex Taxes Filing With TurboTax Is Easy. Social security and Medicare tax for 2022. These are the rates for.

10 12 22. Federal Tax Brackets 2022 for Income Taxes Filed by April 18 2022 Tax Bracket. The maximum Earned Income Tax Credit is 560 for no children 3733 for one child 6164 for two children and 6935 for three or more children.

In addition to the tax rates the IRS upped many of the deductions and exemptions Americans use to lower their taxable income calculation and therefore their taxes. Tax brackets for income earned in 2022 37 for incomes over. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing.

Taxable income between 89075 to 170050 32 Taxable income between 170050 to 215950. Your bracket depends on your taxable income and filing status. Now use the 2022 income tax withholding tables to find which bracket 2025 falls under for a single worker who is paid biweekly.

Look up the key individual and businesses federal tax rates and limits for 2022 in the tables below. All net unearned income over a threshold amount of 2300 for 2022 is taxed using the brackets and rates of the childs parents 2022 Tax Rate Schedule Standard Deductions. For businesses whose tax return deadline is april 18 2022.

IRS provides various prescribed rates for income tax purposes. Each month the IRS provides various prescribed rates for federal income tax purposes. The top tax rate for individuals is 37 percent for taxable income above 539900 for tax year 2022.

2022 Tax Bracket and Tax Rates. Income threshold is 170050 in 2022 for single separate and head of household filers 164900 in 2021 and 340100 for joint filers in 2022 329800 in 2021 select companies above. Ad Compare Your 2022 Tax Bracket vs.

This includes the tax rate tables many deduction limits and exemption amounts. Married Filing Jointly or Qualifying Widower Married Filing Separately. There are seven tax rates in 2022.

Get Your Max Refund Today. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Federal income tax rate table for the 2022 - 2023 filing season has seven income tax brackets with IRS tax rates of 10 12 22 24 32 35 and 37 for Single Married.

Tax Brackets For 2021 2022 Federal Income Tax Rates

Who Pays U S Income Tax And How Much Pew Research Center

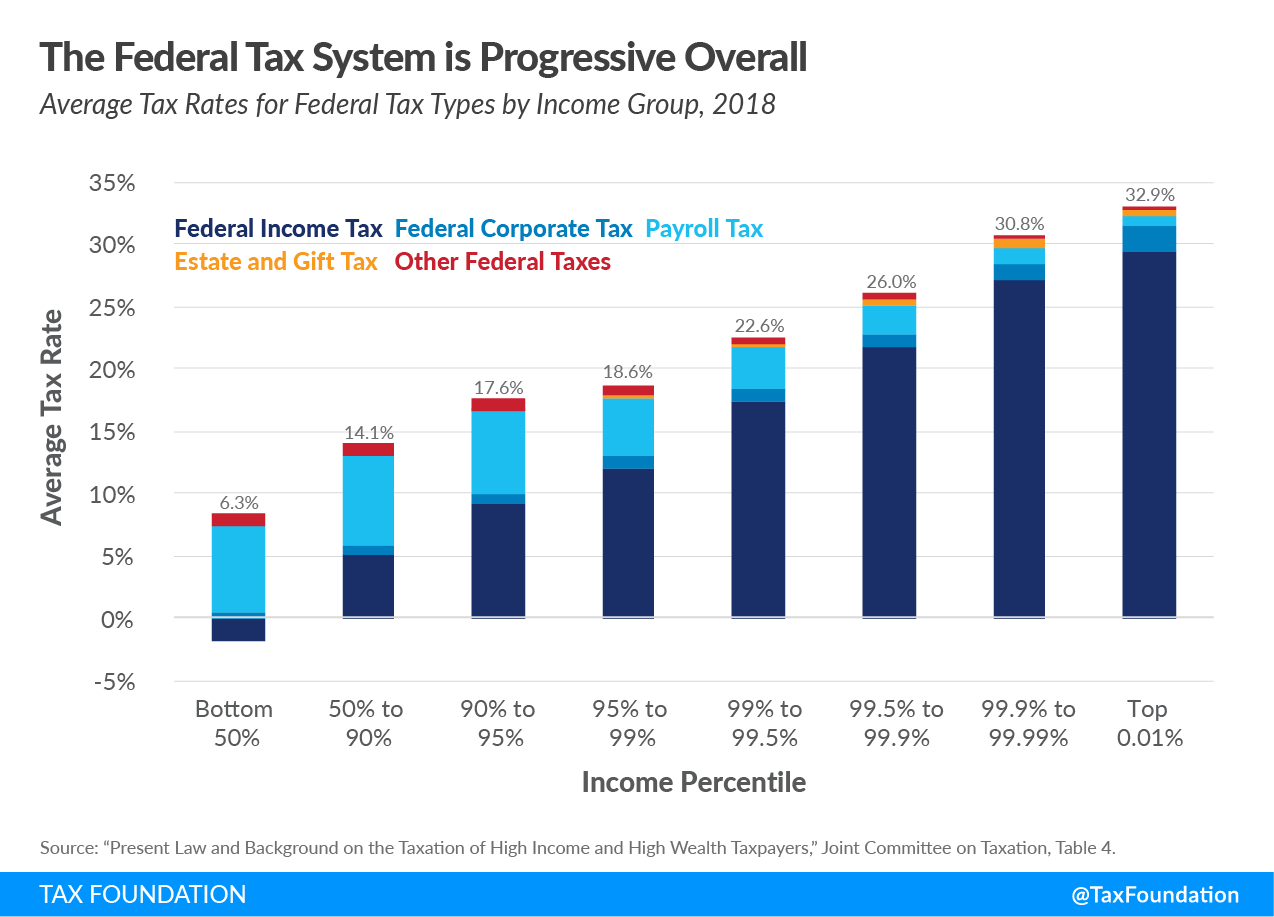

How Progressive Is The Us Tax System Tax Foundation

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

New 2021 Irs Income Tax Brackets And Phaseouts

How Progressive Is The Us Tax System Tax Foundation

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

W 4 Form How To Fill It Out In 2022

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Inflation Pushes Income Tax Brackets Higher For 2022

How To Fill Out A W4 2022 W4 Guide Gusto

2022 Tax Rates Brackets Credits Combined Federal Provincial Tax Brackets Manulife Investment Management

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax